Category: Market Trends and Analysis

-

Archer Aviation (ACHR) Stock Review: Is This eVTOL Pioneer Ready for Takeoff in 2025?

F – Financials A – Advancement Drivers C – Competitive Landscape & Sector Outlook T – Target Price Scenario Price Target (End of 2025) Key Drivers Bear $5.50 Certification delays, slower adoption Base $12.00 Successful Midnight deployment, revenue generation Bull $18.00 Rapid commercialisation, strong partnerships O – Obstacles R – Recommendation Hold with strategic accumulation.…

-

Rocket Lab (RKLB) Stock Analysis: A Rising Space Leader or Risky Bet in 2025?

F – Financials Valuation remains elevated at 10.8x EV/Revenue (2026E) and 22.3x Price/Book, reflecting growth expectations[1][3]. A – Advancement Drivers C – Competitive Landscape & Sector Outlook Competitors: Company Advantage RKLB Countermove SpaceX Lower launch costs (Falcon 9) Neutron’s medium-lift niche Astra Cost-effective small launch Electron’s 100% 2024 success rate Northrop Grumman Defense contract dominance…

-

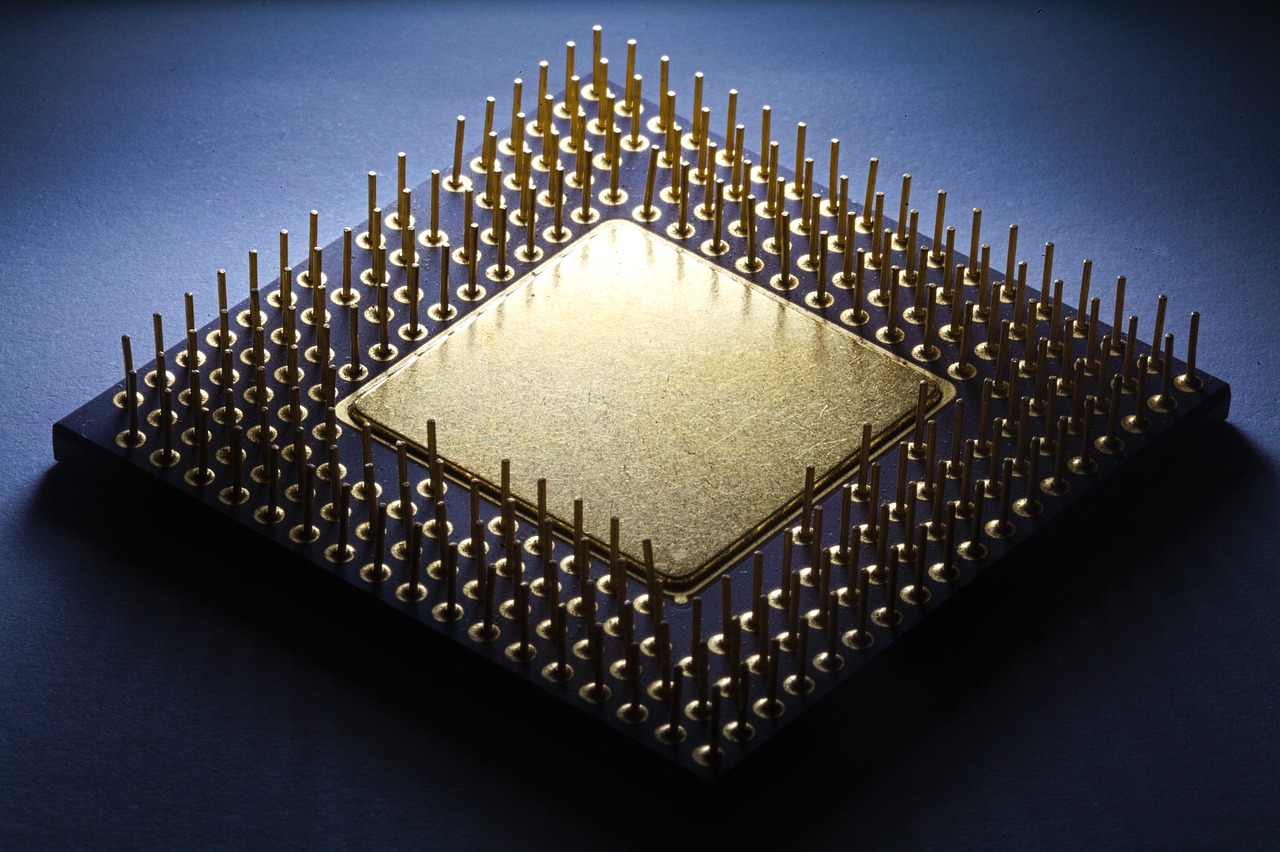

ASML Stock Review: Is This Semiconductor Giant a Smart Buy in 2025?

F – Financials ASML’s financials reflect steady growth despite geopolitical pressures and declining sales in China. A – Advancement Drivers (Growth Catalysts) C – Competitive Landscape & Sector Outlook Competitor Analysis: Competitor Key Advantage ASML Countermove Nikon Cost-effective DUV systems EUV technology monopoly Applied Materials Broad semiconductor equipment portfolio Focus on high-margin lithography systems Lam…

-

Nvidia (NVDA) Stock Review: Is It Still a Buy in 2025? Growth, Risks & Forecast

F – Financials A – Advancement Drivers C – Competitive Landscape Competitor Key Advantage NVDA Countermove AMD Cost-effective MI300X chips CUDA ecosystem lock-in Amazon/AWS Custom Trainium chips Optimized DGX Cloud solutions Intel Gaudi 3 price war Blackwell’s technical moat Sector Outlook: NVIDIA maintains its leadership position in the AI chip market, benefiting from the robust…