Author: Michael Lee

-

Is Greggs PLC (LSE: GRG) a strong contender in 2025 after the dip?

FACTOR Analysis for Greggs PLC (LSE: GRG) – July 2025 F – Financials A – Advancement Drivers C – Competitive Landscape & Sector Outlook Competitor Focus/Strengths Greggs Positioning Tesco, Sainsbury’s Food-to-go, convenience High street and travel hub presence McDonald’s, Pret Fast food, premium coffee Value, bakery, and breakfast/lunch dominance Cooplands, Local bakers Regional bakery chains…

-

Is Baidu, Inc. (NASDAQ:BIDU) a winner in 2025?

F – Financials A – Advancement Drivers (Growth Catalysts) C – Competitive Landscape & Sector Outlook Competitor Strengths Baidu’s Positioning ByteDance Strong in generative AI (Doubao) Baidu leads in industrial/enterprise AI[3] Alibaba, Tencent Cloud, fintech, social Baidu #1 in AI cloud, strong in search Huawei Hardware, cloud Focus on AI software, autonomous driving Sector Outlook:…

-

Outlook for AstraZeneca (LSE:AZN) in 2025.

F – Financials A – Advancement Drivers C – Competitive Landscape & Sector Outlook Competitor Strengths AZN Positioning Roche, Merck Oncology, immunology Broad late-stage pipeline, fast trial execution Pfizer, Novartis Scale, vaccine platforms Focus on specialty/biologics, new launches GSK, Sanofi Vaccines, rare diseases New product launches, emerging market push T – Target Price (Valuation &…

-

Why is GOOGLE (NASDAQ:GOOGL) a strong contender in 2025?

FACTOR Analysis for Alphabet Inc. (GOOGL) – April 2025 F – Financials Alphabet’s financials remain robust, with double-digit revenue and profit growth, expanding margins, and a healthy balance sheet. A – Advancement Drivers (Growth Catalysts) C – Competitive Landscape & Sector Outlook Competitive Landscape Competitor Strengths GOOGL Response Microsoft (Bing, Azure) AI integration, cloud scale…

-

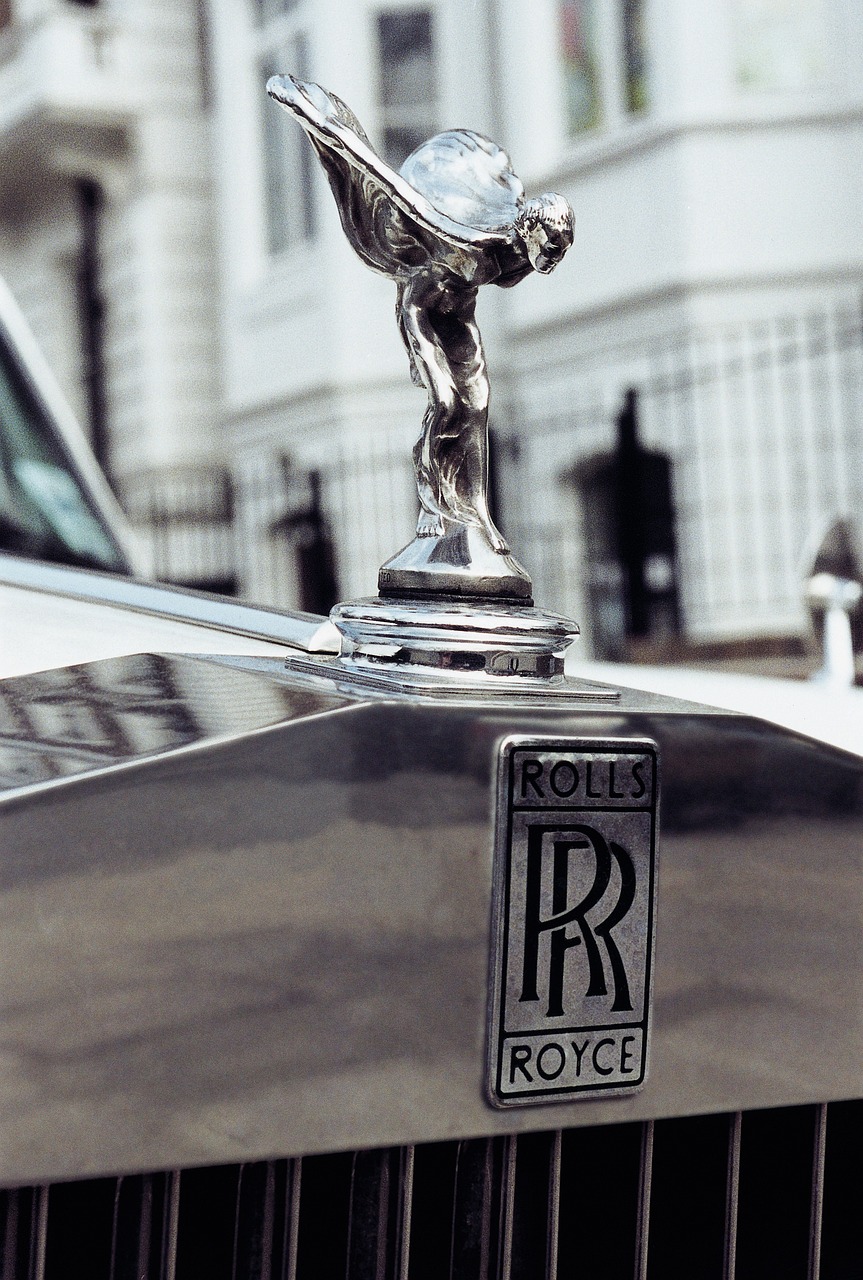

Are Rolls-Royce shares still a bargain in 2025? (LSE:RR)

F – Financials A – Advancement Drivers C – Competitive Landscape & Sector Outlook Competitors: Company Strength RR Countermove General Electric Broad industrial portfolio Focus on premium engine technology Pratt & Whitney Narrow-body engine dominance Trent XWB/UltraFan efficiency Siemens Energy solutions Data center and defense focus Sector Outlook: T – Target Price Scenario 12-Month Target…

-

Is renewables making a come back in 2025? (LSE:TRIG)

F – Financials A – Advancement Drivers (Growth Catalysts) C – Competitive Landscape & Sector Outlook Competitive Landscape Peer Trusts Focus/Strengths TRIG Positioning Greencoat UK Wind Pure wind, UK-centric Broader tech/geographic diversification Octopus Renewables Solar and storage focus Larger, more mature portfolio Bluefield Solar Solar-heavy, UK focus More balanced wind/solar mix Sector Outlook T –…

-

What does RIO TINTO has in store for 2025? (LSE: RIO)

F – Financials A – Advancement Drivers (Growth Catalysts) C – Competitive Landscape & Sector Outlook Competitive Landscape Competitor Key Strengths RIO Response/Positioning BHP Scale, diversified assets Competing in copper, iron ore, lithium Vale High-grade iron ore Simandou project to boost RIO’s grade Glencore Trading, base metals Potential merger, expanding reach Sector Outlook T –…

-

Which sectors would be the winners and losers in the US trade war?

F – Financial Impact A – Advancement Drivers (Sector-Specific) Worst-Hit Sectors Best-Performing Sectors C – Competitive Landscape & Sector Outlook Sector Impact Outlook Renewables Import-dependent supply chains disrupted; U.S. solar/wind projects delayed Growth stalls unless domestic manufacturing scales Autos Foreign OEMs (e.g., Toyota, VW) face 25% tariffs; Tesla struggles with battery costs EV adoption slows;…

-

Is IBM making a come back in 2025?

F – Financials IBM’s financials highlight steady cash flow generation and dividend reliability, offset by slower revenue growth compared to peers. A – Advancement Drivers C – Competitive Landscape & Sector Outlook Competitor Analysis: Competitor Key Advantage IBM Countermove Microsoft Azure Dominance in enterprise cloud Hybrid cloud focus via Red Hat Amazon AWS Market leader…

-

BYD Stock Analysis: Is This EV Giant a Strong Buy in 2025?

F – Financials BYD’s financial performance highlights robust revenue growth, profitability, and rising global sales despite economic pressures in China. A – Advancement Drivers C – Competitive Landscape & Sector Outlook Competitor Analysis: Competitor Key Advantage BYD Countermove Tesla Brand recognition, innovation Affordable pricing (Qin L EV) Volkswagen Strong European presence Localised manufacturing in EU…